Bankruptcy Attorney Tulsa: How Family Law Matters Intersect With Bankruptcy

Bankruptcy Attorney Tulsa: How Family Law Matters Intersect With Bankruptcy

Blog Article

The Steps To Filing Bankruptcy With A Tulsa, Ok Bankruptcy Attorney

Table of ContentsBankruptcy Lawyer Tulsa: The Connection Between Bankruptcy And Consumer ProtectionA Guide To Medical Debt Bankruptcy By Tulsa Bankruptcy AttorneysBankruptcy Lawyer Tulsa: How To Find The Best Fit For Your SituationBankruptcy Attorney Tulsa: Offering Compassionate And Skilled Legal Help

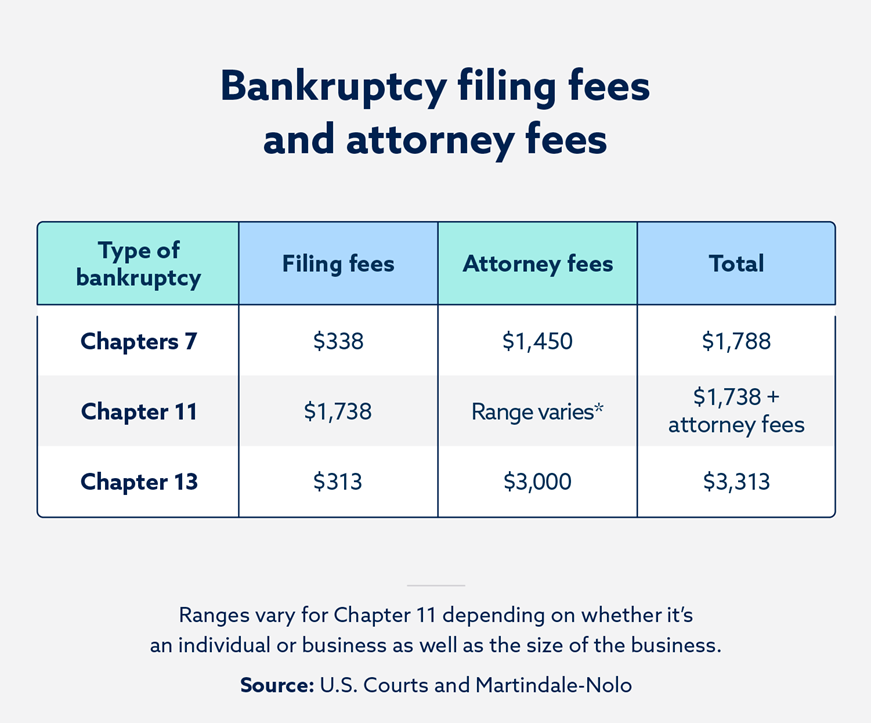

It can damage your credit score for anywhere from 7-10 years and also be a barrier towards obtaining security clearances. Nonetheless, if you can't fix your issues in less than 5 years, insolvency is a viable alternative. Legal representative charges for insolvency vary depending upon which develop you choose, exactly how complicated your situation is as well as where you are geographically. Tulsa OK bankruptcy attorney.Other bankruptcy expenses consist of a filing charge ($338 for Chapter 7; $313 for Phase 13); and costs for credit scores therapy and financial administration programs, which both price from $10 to $100.

You do not always need an attorney when submitting individual insolvency by yourself or "pro se," the term for representing yourself. If the situation is straightforward enough, you can apply for personal bankruptcy without help. A lot of people profit from depiction. This article explains: when Chapter 7 is too complicated to handle on your own why working with a Chapter 13 lawyer is always crucial, and if you represent on your own, exactly how an insolvency request preparer can assist.

, the order getting rid of debt. Plan on filling up out considerable documentation, gathering economic documents, investigating insolvency and exception regulations, as well as adhering to neighborhood regulations and also treatments.

The Value Of A Tulsa Bankruptcy Lawyer In Achieving A Fresh Start

Below are two circumstances that constantly call for depiction., you'll likely desire a legal representative.

If you make a mistake, the personal bankruptcy court might toss out your instance or market possessions you believed you could maintain. If you lose, you'll be stuck paying the financial debt after insolvency.

If you make a mistake, the personal bankruptcy court might toss out your instance or market possessions you believed you could maintain. If you lose, you'll be stuck paying the financial debt after insolvency. You could desire to submit Phase 13 to capture up on home mortgage arrears so you can keep your house. Or you could want to remove your bank loan, "cram down" or minimize an auto funding, or repay a financial debt that will not vanish in personal bankruptcy in time, such as back tax obligations or assistance arrears.

You could desire to submit Phase 13 to capture up on home mortgage arrears so you can keep your house. Or you could want to remove your bank loan, "cram down" or minimize an auto funding, or repay a financial debt that will not vanish in personal bankruptcy in time, such as back tax obligations or assistance arrears.In several situations, a bankruptcy attorney can swiftly determine issues you could not identify. Some people file for personal bankruptcy due to the fact that they do not recognize their choices.

Tulsa Bankruptcy Lawyer: How They Can Help You Eliminate Debt

For the majority of customers, the rational options are Phase 7 as well as Phase 13 bankruptcy. Each kind has certain benefits that fix particular troubles. For instance, if you desire to save your house from repossession, Chapter 13 may be your best choice. Chapter 7 could be the way to go if you have low income and also no possessions.

Below are typical issues personal bankruptcy attorneys can protect against. Personal bankruptcy is form-driven. Several self-represented bankruptcy borrowers do not submit all of linked here the required bankruptcy documents, and their situation obtains disregarded.

If you stand to lose useful residential or commercial property like your house, automobile, or other building you care around, a lawyer may be well worth the money.

The majority of Chapter 7 instances move along naturally. You file for personal bankruptcy, go to the 341 conference of lenders, and also get your discharge. Not all bankruptcy situations continue efficiently, as well as other, extra challenging concerns can arise. Many self-represented filers: don't understand the relevance of motions and enemy actions can not sufficiently protect versus an action looking for to refute discharge, and also have a difficult time complying with confusing insolvency treatments.

Tulsa Bankruptcy Lawyer: How To Keep Your Business Afloat During Bankruptcy

Or something else could appear. The lower line is that a lawyer is crucial when you find on your own on the obtaining end of a movement or legal action. If you decide to declare personal bankruptcy by yourself, learn what solutions are readily available in your area for pro se filers.

Others can link you with lawful aid organizations that do the very same. Lots of courts and also their sites have details for consumers declaring insolvency, from pamphlets describing low-priced or complimentary services to detailed info concerning insolvency. Getting a great self-help publication is likewise an outstanding idea. Search for an insolvency publication that highlights circumstances needing a lawyer.

You must precisely fill in numerous kinds, research the legislation, as well as go to hearings. If you recognize personal bankruptcy legislation however would like aid finishing the types (the average insolvency petition is about 50 pages long), you might consider employing a personal bankruptcy petition preparer. A bankruptcy request preparer is anybody or company, apart from an attorney or somebody who benefits a lawyer, that charges a charge to prepare personal bankruptcy Tulsa bankruptcy attorney documents.

Because personal bankruptcy application preparers are not attorneys, they can't offer legal guidance or represent you in insolvency court. Specifically, they can not: tell you which sort of bankruptcy to submit tell you not to list specific financial obligations inform you not to detail particular assets, or tell you what residential property to exempt.

Because personal bankruptcy application preparers are not attorneys, they can't offer legal guidance or represent you in insolvency court. Specifically, they can not: tell you which sort of bankruptcy to submit tell you not to list specific financial obligations inform you not to detail particular assets, or tell you what residential property to exempt.Report this page